DownFall of the Crypto King - Interesting titbits in the middle of the predictable FUD narrative!

BBC iplayer recently released a documentary on the Sam Bankman-Fried FTX story - Downfall of the Crypto King

It's an entertaining enough watch despite the predictable FUD narrative...

It follows the lifestory of Sam as a child genius and math prodigy getting into crypto off his own back and making billions on his own, the setting up Alamada Research and then FTX.

It follows the crazy boom times in which he and his similarly gifted friends were all living together in luxury condos like students, but running the multi-billion dollar company FTX.

And that crazy party in the Bahamas to which Tony Blaire was invited (news to me!) while crypto had started to crash in the late autumn of 2021.

Then we're introduced to the journalist who broke the story about Alameda Resarch's budget sheet being made up mainly of FTX and dollar liabilities which led to the total and shocking collapse of FTX.

And finally Sam's being arrested, bailed, and then bail being cancelled because of witness tampering, alleged.

TBH it may have been the documentary's bias but I got the impression he must have known he was doing something illegal by transferring money people and companies had invested into FTX to prop up Alameda, and I think he has to hold his hands up to that!

I think he's stuffed... his three closest friends and company colleagues have all pled guilty to fraud, but he hasn't, I don't think he's got a leg to stand on, they'll all probably get deals, or have them already.

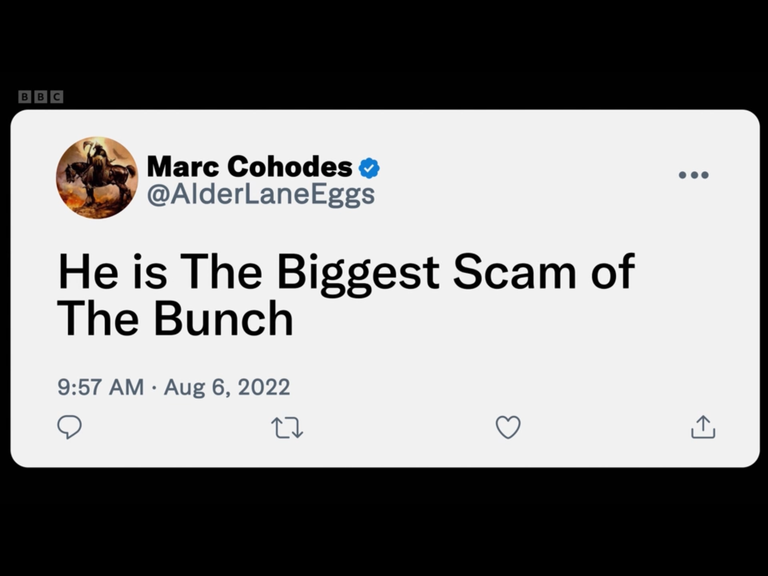

Heavy on the skeptics...

One guy who dubs himself a part-time scammer-hunter gets a lot of air time, based on his ranch to give him a nice wholesome image.

His line is that he saw Sam Bankman-Fried as a scammer straight off///

But no one listened to him: well it was spring 2021! You had to be there I guess!

Victim focused...

There's a few of these....

People who lost money, but the guy above is the biggest loser in the UK that we now of - he had $2M in FTX, but couldn't get his money back, he missed the exit boat.

There was literally no mention of the crypto mantra: DIR and at yer own risk.

And FUD narrative to finish off...

Various collapsing images and themes to suggest crypto is fucked in general....

Overall... 3/10 for the effort

I'd expected a FUD narrative and that's what I got, so to give it 3/10 is about as good as it gets...

They pulled together a lot of decent interviews, albeit not balanced, and I did learn a few insights into just how slap dash the running of the company was.

Fun fact to finish: they had two people working part-time on compliance!

Yeah, lax!

The general media does not do a great job of reporting crypto. They either over-hype it or say it's all scams. Anyone who is investing needs to know the risks, but they get blinded by the APR or 'mooning'. Everyone is after the magic money for little effort.

It's the worst and best of humanity amplified!

Centralized Corporate Media Serves Similar Interests

A general pattern that I have observed, the more centralized media is - the more likely it is to be critical of any endeavors, movements, or ideas that are not equally centralized and controlled by the same groups or concepts.

Crypto Will be Portrayed as Negative Until is Isn't

Crypto will likely be pilloried by media until some significant threshold of assets or chains are owned by legacy institutions then the signal will be given to the media to voice endorsement of those controlled assets. I don't fully understand the landscape of media in the UK, but in the US control of legacy media has been significantly concentrated under the control of a handful of corporations. To make this worse a small group of institutions control an incredible amount of corporate voting power. Blackrock for instance owns between 5-10% of every major corporation.

Decentralized alternatives like HIVE, and similar projects are potential redoubts for free expression and discussion.

Crypto were considered making easy money by many people, they gambled and then lost. Thus, cryptos have little been considered a new technology and the future itself.

I think most of the people who lost money got in in the 2020s. Poor them!